Important do's and don'ts for policy holders

Important do's and don'ts for policyholders

Do's

¢ Pay premium by cheque/DD/pay orders/Online payment modes

¢ Insist for receipt of premium paid

¢ Fill up the proposal form yourself and give complete & factual information, false or misleading information may lead to dispute at the time of claim

¢ Disclose all material facts viz. any disease suffered in the past, details of claims taken on the expiring policy,

¢ On receipt, verify policy details. In case of any discrepancy, report immediately to avoid any inconvenience

¢ Provide updated address and contact no for correspondence

¢ Buy policies from Licensed IRDA agents & brokers

¢ Please report if the policy is not received within 15 days after payment of premium.

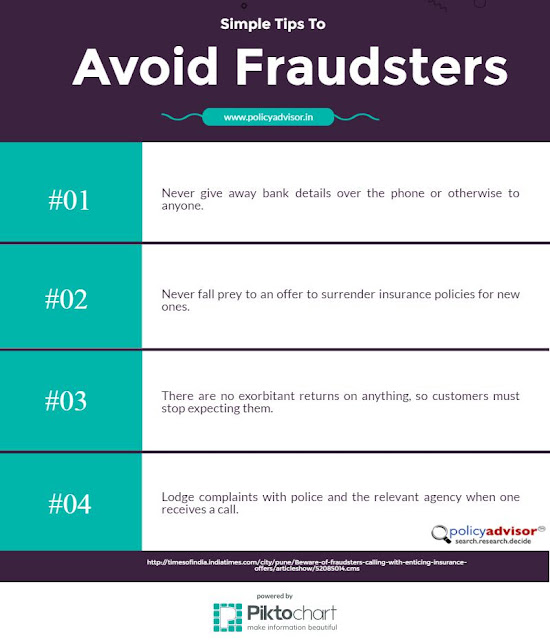

Don'ts

¢Don't pay cash to any unauthorized person.

¢Don't sign a blank proposal form.

¢Don't provide false or misleading information.

¢Don't leave any portion of the proposal form blank or unanswered.

¢Don't share sensitive information via. credit card, debit card, bank details etc. over the phone to the Tele caller.

Comments

Post a Comment