Will I lose renewal benefits if I transfer my health policy to another provider?

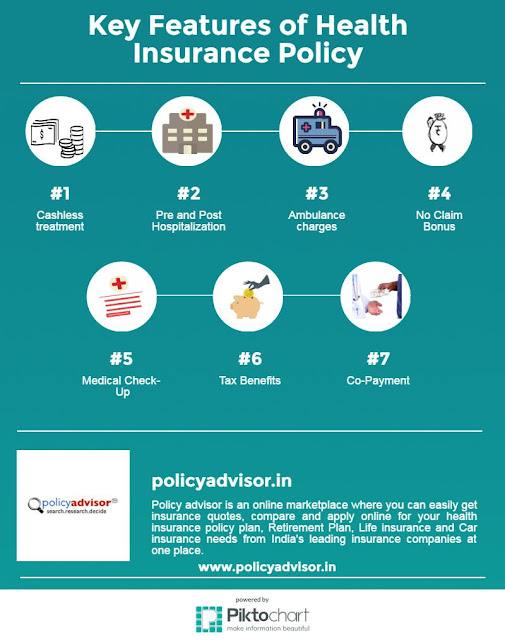

Will I lose renewal benefits if I transfer my health policy to another provider? The IRDA directs insurance companies to allow health insurance portability from one insurer to another without loss of renewal credit for benefits enjoyed in the existing policy. This is limited to the extent of the sum insured, including the cumulative bonus/ no claim bonus. Exact details are available in your policy document.